Who Can Contribute To A Roth Ira 2025

Who Can Contribute To A Roth Ira 2025. That means roth ira contributions for 2025 can be made until april 15,. Edited by jeff white, cepf®.

The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age. Ira contribution limits for 2025.

Next year, the roth ira contribution limit for savers under 50 will jump to $7,000, up from $6,500 in 2025.

ira contribution limits 2025 Choosing Your Gold IRA, Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000. Edited by jeff white, cepf®.

Roth IRA Who Can Contribute? The TurboTax Blog, Ira account holders can contribute up to $7,000 in 2025, which is a $500 jump over the 2025 cap. The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older.

2025 Roth Ira Limits Trude Hortense, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025.

2025 Simple Ira Contribution Ilise Leandra, In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50 or older. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age.

Last Day To Contribute To 2025 Roth Bill Marjie, Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000. As a general rule, you have until tax day to make ira contributions for the prior year.

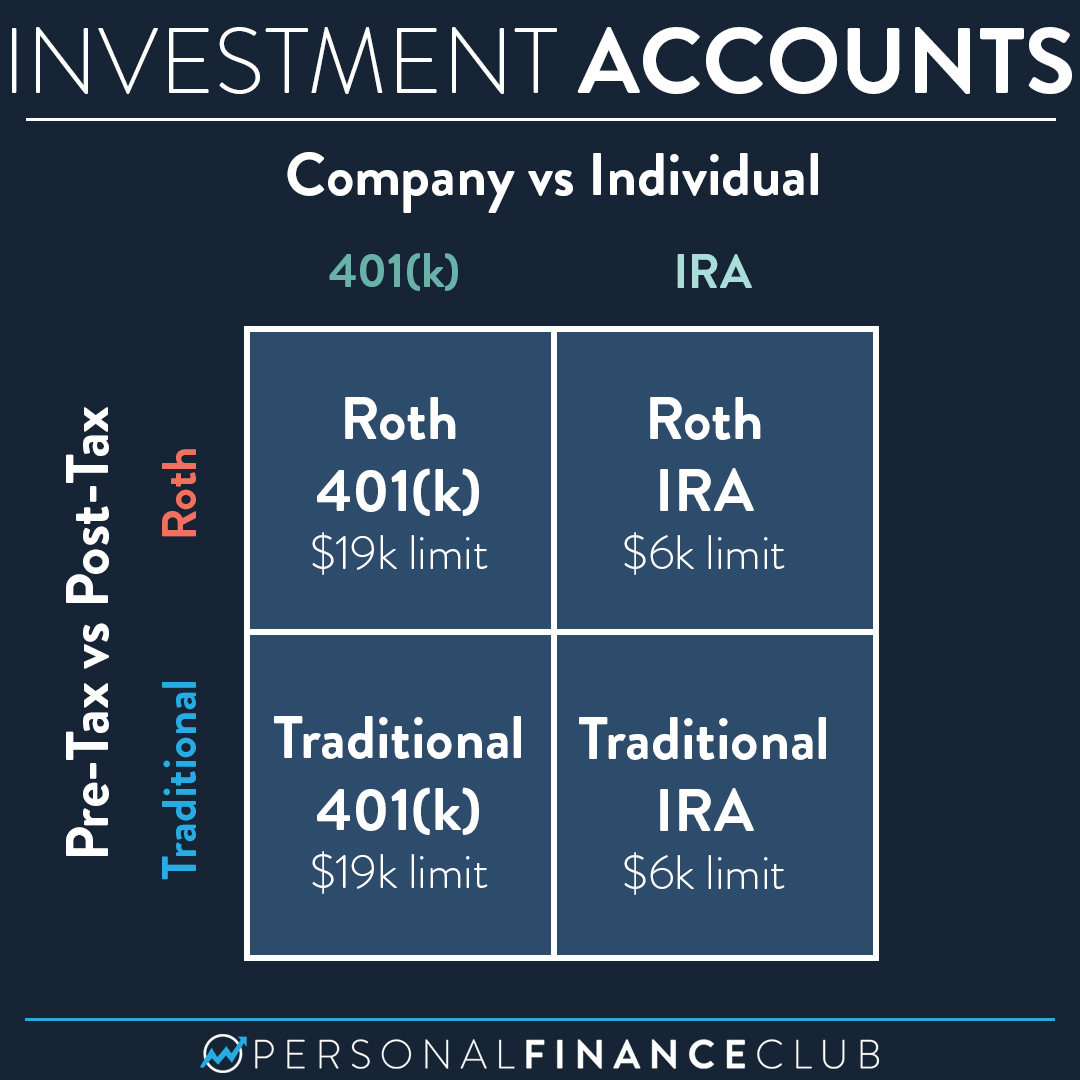

roth ira vs traditional ira Choosing Your Gold IRA, Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2025. Your tax filing status also impacts how much you can contribute.

How much can I contribute to my Roth IRA 2025 Inflation Protection, Ira account holders can contribute up to $7,000 in 2025, which is a $500 jump over the 2025 cap. The roth ira contribution limit is $7,000 in 2025.

How Much Can You Contribute to a Roth IRA for 2019?, Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000. If you're age 50 and older, you.

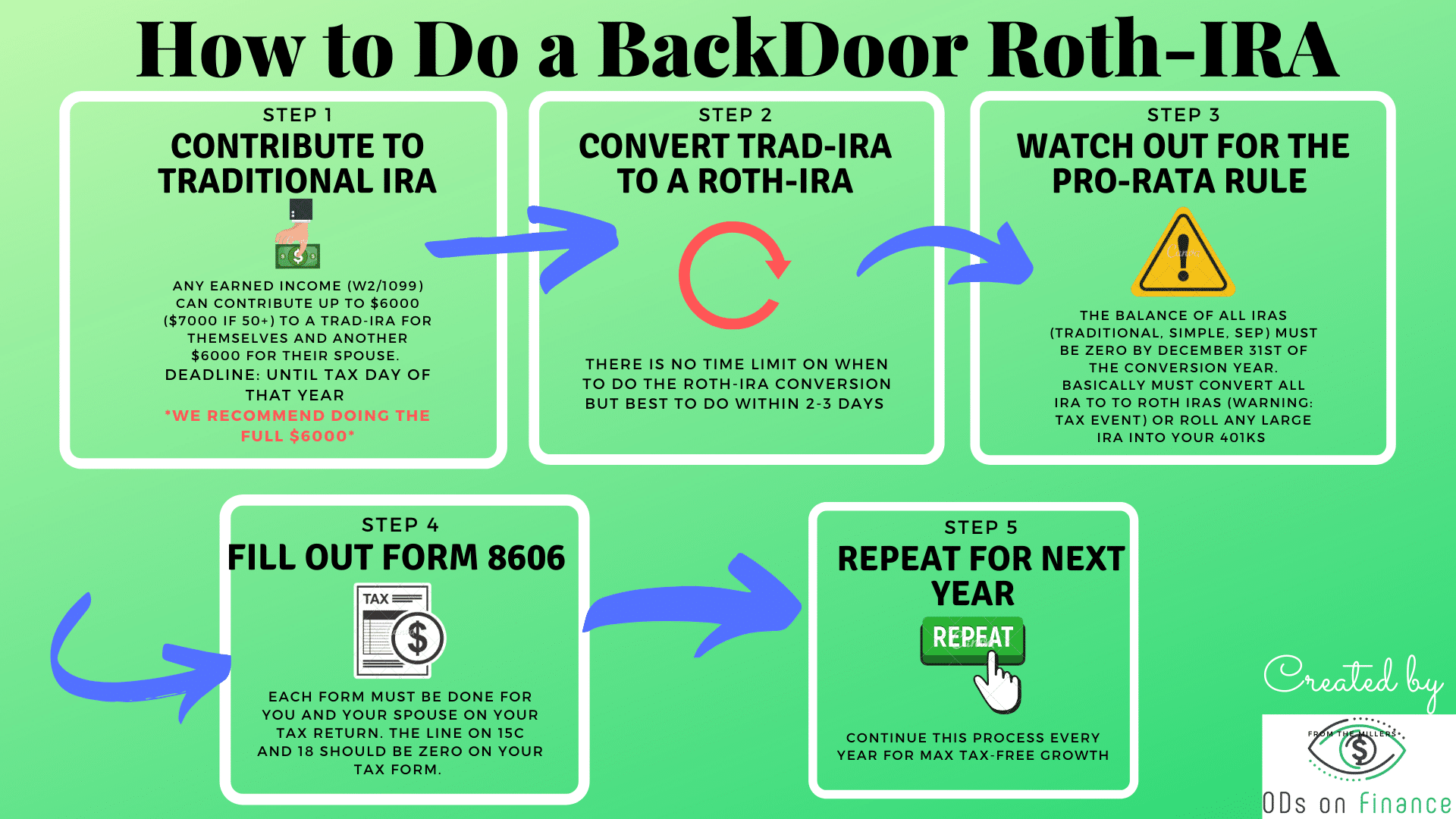

Why Most Pharmacists Should Do a Backdoor Roth IRA, In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50 or older. The income limits for the roth ira apply only to roth ira contributions, so you could still contribute to a traditional ira up to the $6,500 (or $7,500) limit for 2025,.

Can you contribute 6000 to both Roth and traditional IRA? Retirement, In 2025, that means you can contribute toward. The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older.